You probably don’t like talking about (or even thinking about) your credit card processing rates but if you accept credit cards on your website for payment, then you better be considering how much it’s costing you! You don’t have to be an expert in credit card processing but you need to know enough to make sure you’re not throwing away money on ridiculously high fees.

LAre You Getting Screwed by High Credit Card Processing Fees?

A common-sense method to make sure you’re getting a good deal on anything is to compare costs with other customers buying the same thing. We do it with everything else from cars to groceries.

So let’s compare credit card processing fees…

I recently switched credit card processors and am paying a lot less. I didn’t even think I was paying too much but was surprised when I got a quote from a competing company and they were much cheaper than my current card processor.

Before I share the details, let me tell you a little bit about what I learned about credit card fees in the process of switching.

How Credit Card Processing Fees Work & What I WAS Paying

There are different types of fees that you need to understand when it comes to credit card processing. I’ll list them here and explain what I was paying with my previous processor.

There are different types of fees that you need to understand when it comes to credit card processing. I’ll list them here and explain what I was paying with my previous processor.

Gateway Monthly Fee – The gateway company initiates your transaction on your website and ensures information is transmitted securely. My gateway company was Authorize.net. I was paying them a flat monthly fee of $24.85/month

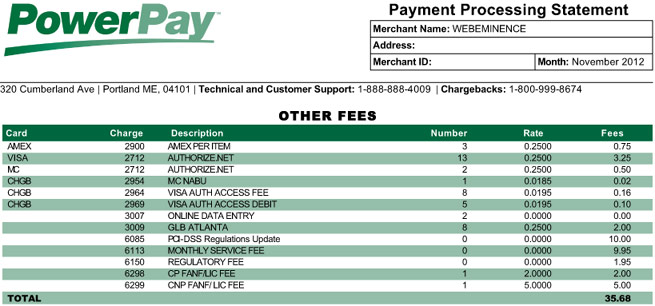

Processor Monthly Fee – The processor is the actual company processing your credit card transaction and transferring money to your bank account. Authorize.net links up with many credit card processors, but my account was with PowerPay. They were charging me a flat fee of $30.90/month. This included a PCI Compliance fee of $10.00, service fee of $9.95, and regulatory/license fees of $10.95.

American Express Merchant Fee – American Express operates as a separate credit card processor. Their monthly fee was a flat $19.00 for me. For simplicity, we’ll leave that out of this discussion.

Discount Rate Fee – These are the big daddy of credit card processing fees. The discount rate is the percentage of each transaction that is deducted before the deposit is made in your bank account. With Authorize.net/Powerpay, I was paying rates of 2.21% to 3.31% depending on the type of credit card. Many credit card processors use these variable tiered rates for different types of cards (rewards cards, business cards, debit cards, etc.) because their costs are different for different types of cards.

Some people view this as a sneaky way of charging extra by processing more of the charges at the higher rate. The majority of my transactions are at the lower rate so I’d like to think that it is the processors way of making sure they are charging the lowest rate possible. But who really knows? and who is really checking? Probably not too many people. It probably just depends on what processor you choose, but the goal should be to get the tiered rates as low as possible.

If you are getting charged tiered rates, it would be wise to check your statements to see what percentage of your transactions are getting charged at the different rates. For a more detailed look at tiered rates and ALL the details of credit card processing fees, here’s a really informative post at CardFellow.com.

Other Fees – The other fees in my PowerPay statements included assessment fees, batch fees, and access fees. These were usually only about 0.6% but that’s a large percentage considering I didn’t account for these fees and instead focused on the discount rate. These fees are typically charged by any credit card processor and they claim they are just passing along their own costs from the credit card companies.

To learn more about processing and other fees, you may visit credit union credit card rewards resource site.

My Total Cost – $55.75 per month + 3.3%

When someone asks “What are your credit card fees?”, the answer is usually a monthly payment and a percentage. In my case, if you add up all the costs above, I was paying $55.80 a month and about 3.3% in total fees. That’s pretty high by industry standards. My monthly volume was below $2,000 at the time so this amounted to a total cost of around 7%. That’s a pretty big slice of the revenue pie. Don’t get me wrong, I like pie, but this kind of pie makes me sick!

My New Deal – $11.95 per month + 2.5%

I recently got a business checking account from my bank and they hooked me up with their credit card processor Moneris.

I recently got a business checking account from my bank and they hooked me up with their credit card processor Moneris.

I figured I would at least see what their costs are since I knew my costs were high. As it turns out, their fees are much lower. They do charge tiered rates but they range from 1.99% to 2.99% compared to the 2.21-3.31% that I was paying.

They also do not have a batch fee and some of the regulatory fees I was paying with Authorize.net/Powerpay.

Another huge savings is that their total monthly fee is only $11.95 compared to the $55.80 I was paying. That’s a pretty big cost savings, especially for customers processing less than $5,000 per month. One of the reasons the monthly fees are lower is I’m not paying two companies anymore. Moneris processes payments through their own processor, eSELECT Plus, and that is included in the monthly fee.

Am I Happy Now?

I’m happy to be saving money but am I getting the best deal now? The truth is…I’m not sure. That’s part of my reason for writing this post. I’m curious to hear feedback from you on what you pay for credit card processing fees. Maybe I’ll find an option to save even more money in the future. Or maybe I’ve helped you realize that you are paying way too much in credit card fees with your current processor.

I’m happy to be saving money but am I getting the best deal now? The truth is…I’m not sure. That’s part of my reason for writing this post. I’m curious to hear feedback from you on what you pay for credit card processing fees. Maybe I’ll find an option to save even more money in the future. Or maybe I’ve helped you realize that you are paying way too much in credit card fees with your current processor.

UPDATE: Switched to FirstData

A few weeks after publishing this post, I had some trouble linking up my new Moneris payment processor through my shopping cart from 1ShoppingCart.com. After some back and forth with both companies, I realized 1ShoppingCart.com supports Moneris Canada but not Moneris US. So even though they offered a competitive low cost, I was unable to use Moneris to process payments with the shopping cart I’m already using.

So I started searching again and this time I used CardFellow.com to search for payment processors. With CardFellow.com, you complete an application and get offers from several payment processors with their complete costs listed up-front. It’s a very transparent process. I contacted FirstData since they offered one of the lowest cost options and I know they link up with my shopping cart.

So I started searching again and this time I used CardFellow.com to search for payment processors. With CardFellow.com, you complete an application and get offers from several payment processors with their complete costs listed up-front. It’s a very transparent process. I contacted FirstData since they offered one of the lowest cost options and I know they link up with my shopping cart.

As it turns out, I am getting a lower cost with FirstData even compared to what I was getting with Moneris . FirstData is charging Interchange + .25%. Interchange is the rate charged by credit card companies that all processors pay. So processors offering a quote at interchange plus a percentage are being transparent about the profit they are taking on all transactions. Their monthly fees were much cheaper at $17 total per month since American Express processing is included.

All in all, I’m happy with the entire process with FirsData. From the sales process all the way to linking my shopping cart to FirstData, they have been very helpful so far. I’ve already processed a few transactions successfully and hope I won’t be needing to switch payment processors for a very long time.

2017 Update: Four Years Later

It’s June 2017, 4 years after I wrote this post and I’m still with FirstData. As is the case with most people, I’m pretty busy and don’t take a lot of time to review my statements. My fees have remained mostly the same. My interchange + .25% is still in place but some monthly fees have been added. They are mostly service fees and security fees which is pretty annoying, but since I’m processing 5 times the amount I was 4 years ago, the small monthly fees aren’t as big a deal. I’m typically around 3.3 – 3.5% total cost including all fees on my statement.

Comment below and tell me how much you are paying in monthly fees and % rate? Which company are you using?